The Green Zone Briefing

Weekly frontline intel on capital markets, funding, and strategy — no fluff, no spin.

The Quiet Forces Reshaping Commercial Banking and Business Credit as We Enter 2026

Commercial bank consolidation reshaped how business loans are approved. Here’s why access to capital feels tighter and what comes next in 2026.

The Fed Rate Pivot Doesn’t Fix Your Access to Bank Financing in 2026

Rate cuts don’t make business loans easier to obtain. Underwriting has tightened while renewal risk rises. Middle market companies need a capital strategy now.

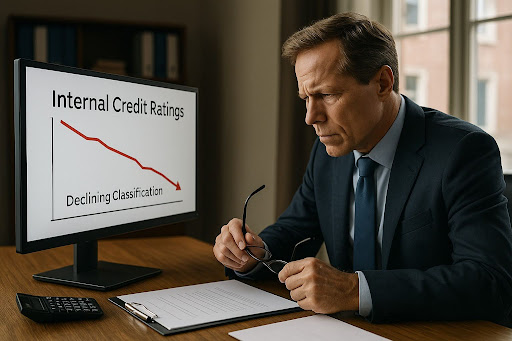

Confidence Cracks: Bank Loan Committees Are Quietly Reclassifying Borrowers

Banks are quietly tightening internal risk ratings even for strong borrowers. This hidden shift will determine credit access, pricing, and structure in 2026

Confidence Cracks: The Banking Industry is Changing the Rules

Banks are changing the business loan rules by tightening underwriting standards and shortening timeframes. Middle-market companies must adapt their financing strategy now or face access gaps in 2026.

Strategic capital financing solutions for high-growth businesses and private equity partners.

COMPANY

SUPPORT

LEGAL

FOLLOW US

Copyright 2026. Green Zone Capital Advisors. All Rights Reserved.